Livestock –

Livestock –

Cash cattle news was quiet on Friday. For the week it looks like sales were up about +$4 at $116. Today cash activity should be limited to the distribution of showlists. Initial asking prices should be around $118. The market will likely trade the Cattle on Feed report that was released Friday.

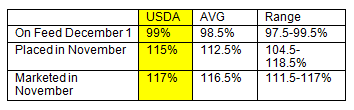

In general the report appeared neutral to slightly bearish. The number of cattle on feed was slightly above expectations, but not enough that it should push the market. The number of Marketings and Placements topped the average guess. Placements were 115%, which is 2.5% larger than expected and Marketings were 117% which is slightly above expectations. This means that the spread between Placements and Marketings was narrower than expected ; the market was expecting Marketings to be 4% larger than Placements but Marketings came in only 2% larger than Placements. We continue to place some pretty heavy cattle with 800lbs + being over 450K., however there was a large jump in year over year numbers for cattle weighing 600-699lbs. Maybe this means we are returning to a time where we will place some lighter cattle. Also, cattle on feed 120 days and up was down 14.9% versus year ago levels.

The Hogs & Pigs report was generally viewed as bearish with almost all categories on the report coming in higher than expected. The H&P inventory at 71.5 mil head is a record for the month of December; which shouldn’t be a huge surprise considering we have seen record breaking slaughter levels almost every other week. Additionally, it doesn’t look like producers are letting off the gas with farrowing intentions all being larger yoy. Additionally, the number of pigs per litter was much higher than expected. The USDA made some revisions to past data, which appears to be an attempt to catch up to the large number of animals we are seeing move through the system. A net revision was made increasing the June 2016 all hogs and pigs inventory by +1.3%. A revision of 2.5% was made to the March-May 2016 pig crop. A revision of 0.6% was made to the September 2016 all hogs and pigs inventory.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.