Grains –

Grains –

After briefly touching new highs soybean futures have been in correction mode for a little more than a week now. One market that appears to have no interest in any such corrections is the Brazilian real. The USD-BRL is on the verge of breaking into new lows, and remember on this cross the lower it goes it means the BRL is stronger against the dollar. Over the past year, the BRL has been the strongest currency in the world, gaining roughly 28% against the USD.

As I’m sure you’d expect, this has major implications on the price of soybeans in BRL terms as priced to Brazilian farmers. Since the beginning of 2016 soybeans in USD terms are up roughly 20% while soybeans in BRL are down roughly 8%. This clearly is not encouraging the Brazilian farmer to be a forward seller of soybeans. Private Brazilian analyst group Celeres is estimating forwards sales are 39% complete compared to 45% at this time last year.

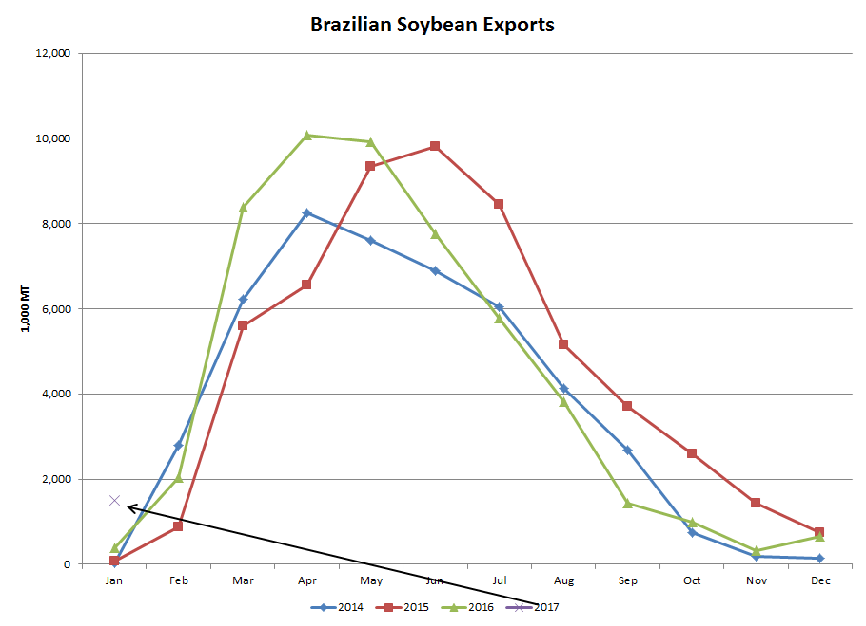

Export markets are likely to be very quiet this week as you’d expect during the Chinese holiday. Still, I think if the BRL strength continues without some upside support to soybean flat- price we’ll see Brazilian exporters struggle to source ample soybeans over time. Of course “over time” has to be a very popular expression among morning wire authors and combined with the “if” statement preceding it I have to acknowledge I have no idea what sort of timeframe it means. Clearly the Brazilian export program is already getting a good start this year. Combined with a slightly ahead of normal harvest pace, we’ve also got some old crop supplies that are likely being funneled to the initial export shipments of the year. It’ll be a few more days before we have official Jan data, but based on numbers we have to date we can ball park Jan shipments at roughly 1.5 mmt. As you can see from the attached chart this would be the best start to the export season in several years and certainly doesn’t imply a problem in origination today. That said, I believe the longer the BRL remains this firm the less willing the Brazilian farmer will be to part with his soybeans. This will be a story that likely takes months to unfold.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.