Livestock –

Livestock –

Virtually no new cash market info to digest from yesterday in cattle, other than the new showlists which are once again smaller than the prior week. We saw a somewhat light slaughter posted yesterday and from the packers’ perspective this might be needed to support boxes and calm down cash trade a bit. It remains to be seen if this light pace will continue for the remainder of the week.

Hog trade continued to march higher yesterday following cash support. The cash index is now up to $72, likely supporting some further gain in the near term. There seem to be rumblings that export demand to Mexico is starting to tail off a bit, and so we’ll need to closely watch export sales each week in the near future. If export business is starting to taper a bit at these levels, it might provide a catalyst for some sort of correction.

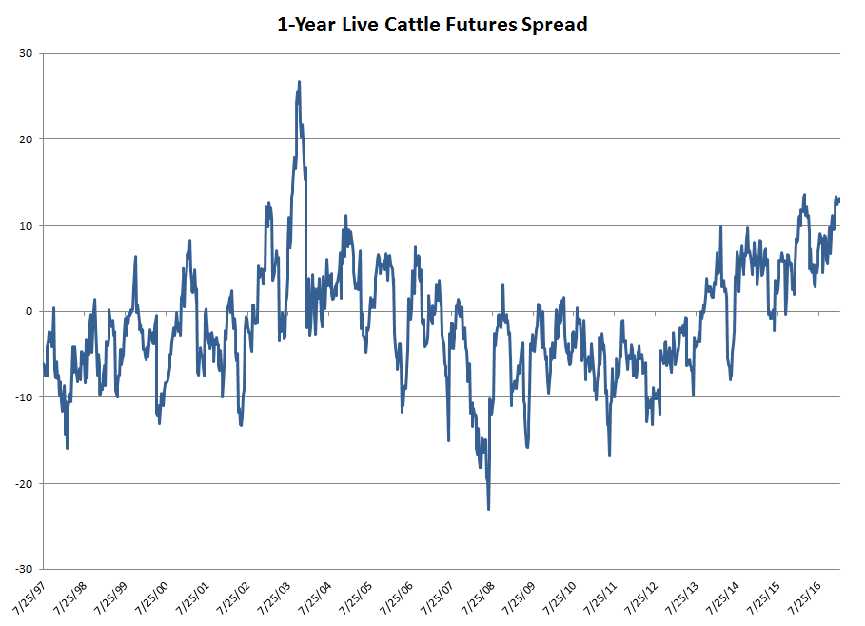

Below you’ll see the interesting chart of the day. Here we have the spread between the spot live cattle futures and the contract 12-months out (shown as percent the above/below of the spot month). What this is basically showing is that the inverse in the cattle futures has grown to its highest levels since 2003. I believe the reason for the huge inverse at that time was the first case of Canadian BSE.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.