Financials –

Financials –

No change in recent themes overnight. Global equity markets are relatively flat and the dollar is higher against most other currencies. The dollar strength stems in large part due to euro weakness and ongoing concerns over political situations there. A lot of elections are on deck, with the Dutch just around the corner in just a few weeks. A ruling on President Trump’s travel ban could come at any point in the week and this could prove to be market-moving I suppose. Note that Fed speakers in the past few days have been a mix of hawkish and dovish, giving no real solid lean on their bias. Of course their latest statement was definitely dovish. Fed Chair Yellen will testify to Congress next week and that should be interesting.

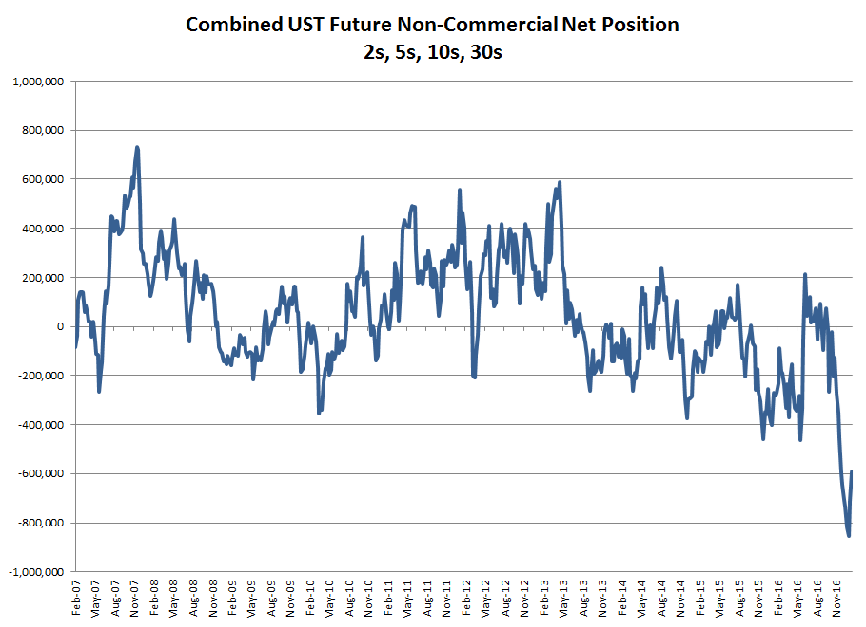

The UST market will be in focus today. Following a solid 3-year auction yesterday, we’ll get a more market-moving 10-year auction at noon today. Indirect bidders were strong takers of yesterday’s 3-year auction, and it’ll be interesting to see if that follows through today. Note that specs have liquidated some of their massive short position in USTs but we are still much larger than usual. Meanwhile the charts have formed a fairly solid base here, so further favorable auction results might encourage additional short liquidation.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.