Grains –

Grains –

I’ve started/stopped/restarted writing these comments today several times. To be honest, I’m at a loss for words following yesterday’s session. From a risk management perspective, how are we supposed to account for an unelected “regulation czar” sending memos to the President on major policies? How do you risk manage for corn trading almost its entire monthly range in the final session of the month?

Here is what I can say on the two key market-moving pieces of yesterday’s alleged policy shift. On the potential move to E-15, this will take a long time to implement. There are just a handful of gas stations set up to handle E-15 at the moment not to mention all the debate over whether older cars can handle it (prompting increased signage, etc). In addition, the ethanol industry is already running at max capacity at the moment. Additional corn demand from E-15 blends will either eat into our exports or will simply have to take time for additional capacity to be built.

On the biodiesel producer tax credit, this would have a very quick impact if realized, but keep in mind that this would require Congressional approval. There is a reason the tax credit didn’t get reinstated late last year, so just assuming this will happen easily seems naïve. Still, if we assume the tax credit is reinstated for the producer, then it instantly slows down the surge of biodiesel imports into the US. Biodiesel imports have surged this year to help meet the growing mandates and frankly, it will be impossible to meet these mandates without imports. It just doesn’t work. Consider the math. Last year we imported roughly 700 mil gals of biodiesel. Conservatively this will require 7.35 x 700 = 5 billion lbs of some sort of domestic feedstock (presumably soyoil). Take soyoil exports and carryout to zero and you’re still looking at a 1.3 bil lbs feedstock shortfall. You simply cannot meet the biodiesel and advanced mandates, as currently written, without significant imports.

Admittedly, none of the above really has to matter to the market right now. “Investment” interest remains very strong for commodities right now and this is just another storyline encouraging more to pile in, as evidenced by the surge in OI yesterday. Charts held key support levels and will likely continue to find solid support at these levels for the near future. With what appear to be huge South American crops in the pipeline, it makes me wonder what it will take to signal “last call” for this extended spec position. My guess is they’ll stick around to see if the US runs into any crop difficulties this spring/summer before hitting the exits. In the short term, that means choppy and at times nonsensical price action.

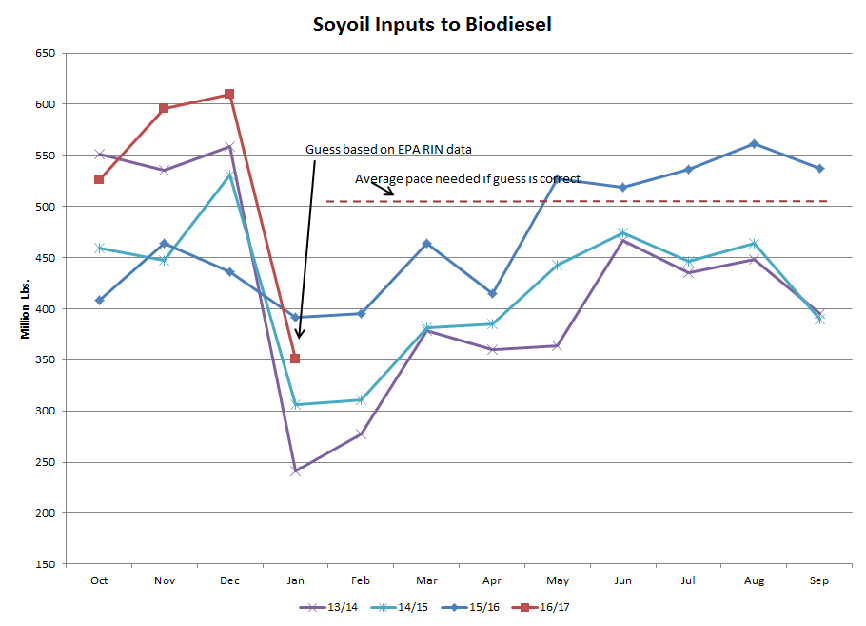

Coincidentally, the EIA did report monthly biodiesel production for December yesterday. The figure was large, as expected, as many wanted to take advantage of the expiring blending tax credit. Still, overall production came in lighter than I expected based on the EPA’s RIN figures. Soyoil use in biodiesel production totaled 610 mil lbs and as shown in the attached chart I’m looking for soyoil use in the Jan figures to decline sharply based on the EPA RIN numbers. The WASDE soyoil use projection is clearly within reach, but we’ll definitely want to see a pick up from the projected Jan levels soon.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.