Crops –

Crops –

We’re just a few days away from the Crop Production & WASDE reports, and that will be our primary focus for the remainder of the week. This morning I want to briefly discuss prospects for winter wheat production. Unfortunately, we still don’t have much actual harvest data to work with as cutters are just now getting ready to cross into southern KS. Until we get a little more actual data, we’re still going basically off of guess work here.

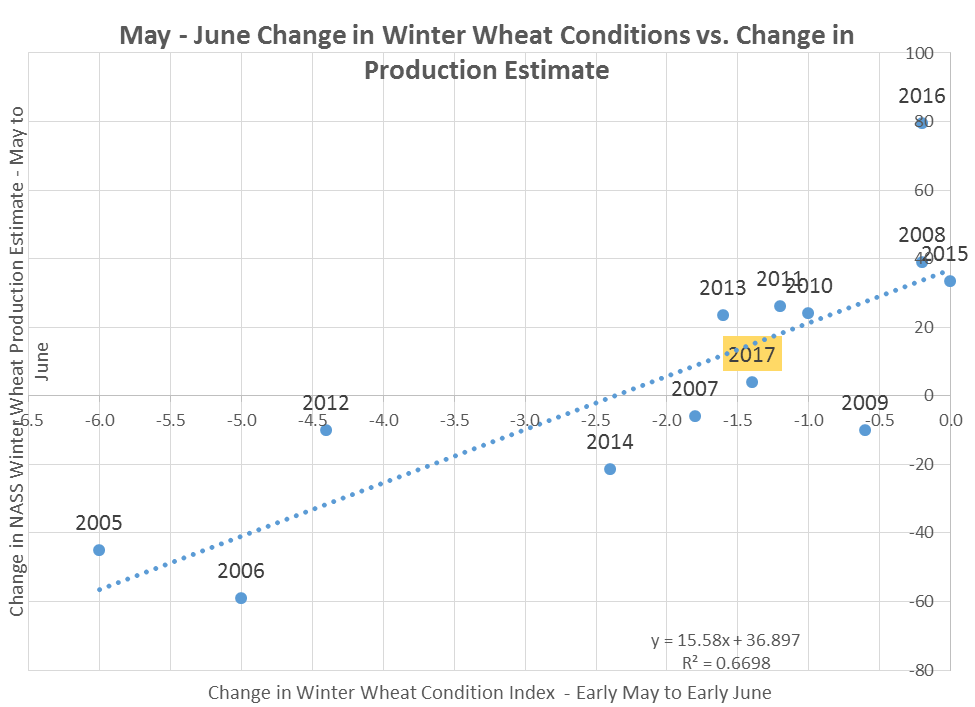

During the summer months I’ve shown before that NASS changes in their yield figures can sometimes be derived by observing the changes in crop condition ratings. I wonder if that would be the case with wheat and decided to look at the change in early-May to early-June condition ratings vs. the overall winter wheat production change from May to June. Note I’m looking at production here and not yields. I actually did run yields as well, but the relationship was not very good at all. As you can see below, the relationship on the condition change and production change, while not concrete, is pretty decent. Obviously this is probably due to changes in harvested area and abandonment and how that factors into the yield projection.

So based on the scatter, I can’t say I have any major beef against the average guess on production right now. I’ve noted before that condition ratings might imply a slightly lower abandonment figure than NASS showed in their May report, but I also wonder if the current low price environment might skew that to the high end of a normal range? Long story short…I think the average guess on production is good enough considering we won’t know anything for certain until we get some combines rolling through Kansas.

Please note this is just a small sampling of commentary available to clients. Please visit www.nesvick.com for more information.

DISCLAIMER:

The information contained herein has been taken from trade and statistical services and other sources we believe are reliable. Opinions expressed reflect judgments at this date and are subject to change without notice. These materials represent the opinions and viewpoints of the author and do not necessarily reflect the opinions or trading strategies of Nesvick Trading Group LLC and its subsidiaries. Nesvick Trading Group, LLC does not guarantee that such information is accurate or complete and it should not be relied upon as such. Officers, employees, and affiliates of Nesvick Trading Group, LLC may or may not, from time to time, have long or short positions in, and buy or sell, the securities and derivatives (for their own account or others), if any, referred to in this commentary. There is risk of loss in trading futures and options and it is not suitable for all investors. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RETURNS. Nesvick Trading Group LLC is not responsible for any redistribution of this material by third parties or any trading decision taken by persons not intended to view this material.