T4 Options Pro

- Generate theoretical option values and Greeks from customizable models

- Monitor the marketplace to discover and quickly execute trading opportunities

- Create and instantly value User Defined Spreads (UDS) and RFQs

- Compare live market trades to your theoretical values in real-time

- Analyze actual and potential positions against multiple market conditions

Theoretical Sheets

Strategy Solver

Portfolio Analysis

Model Management

FaST Board

Multi-Account Analysis

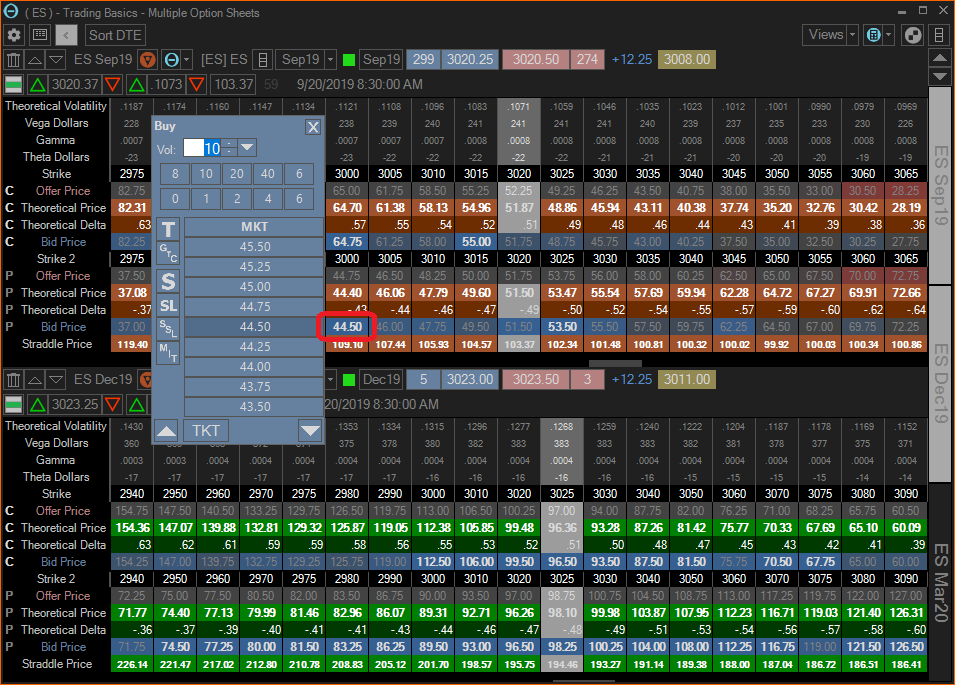

Theoretical Sheets

Theoretical pricing sheets serve as the primary trading tool in Options Pro. Multiple views allow you to customize sheets to display only the theoretical values and Greeks that matter to your trading style. Use heat maps to scan for edge, then click on any bid or offer to open a price prompt window for quick trade execution. Click on deltas to instantly create, value, and trade option strategies in our Strategy Solver. Included with Options Auto 1, Options Auto 2, and Options Pro.

Strategy Solver

Add multiple legs to the Strategy Solver to see the theoretical spread price, Greeks, and heat mapped bid/offer data in real-time. If a spread does not exist yet, simply click a button to create the UDS at the exchange and send out an RFQ. Create strips, covered strategies, and ratio spreads with ease, then trade them directly from the Strategy Solver or save them for later analysis. Included with Options Auto 2 and Options Pro.

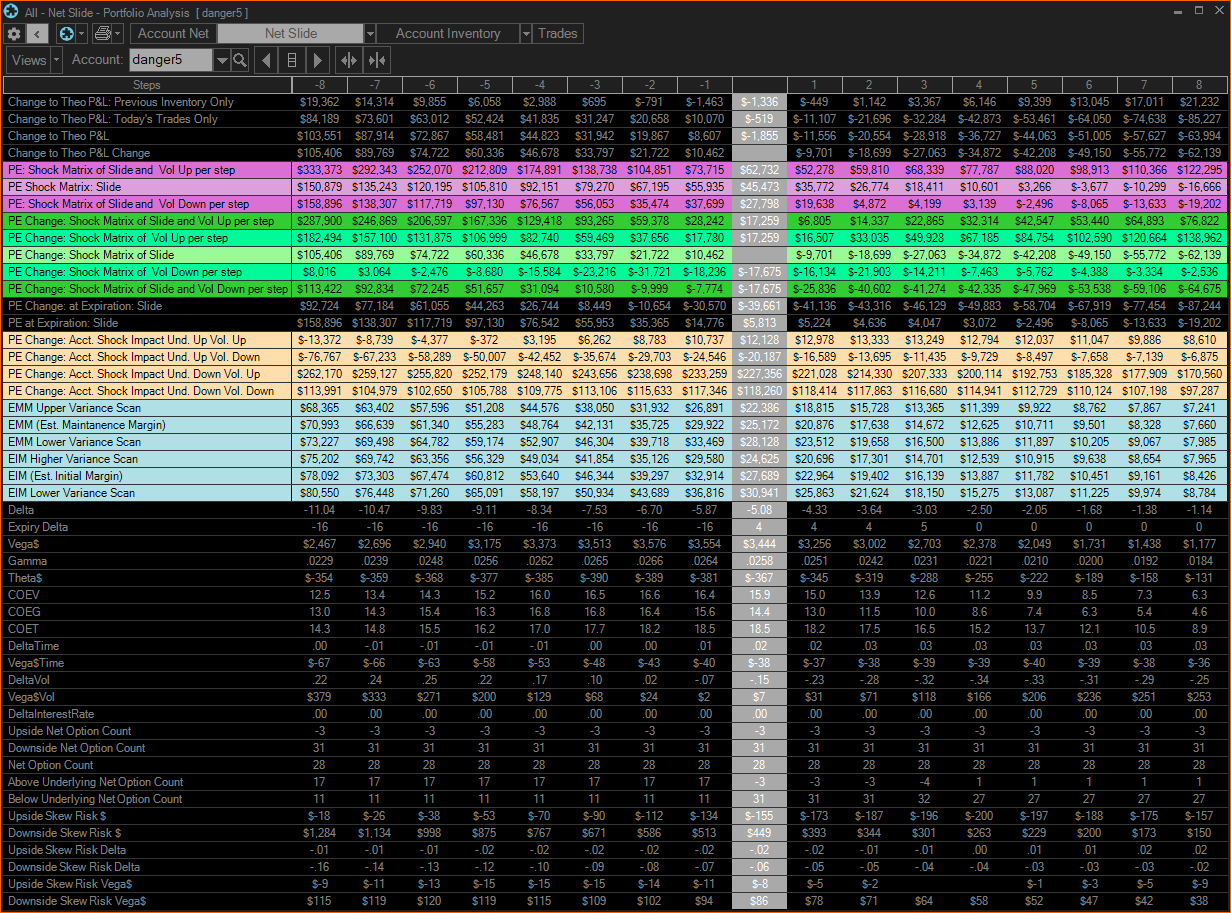

Portfolio Analysis

Manage risk across your entire portfolio in one customizable window. Reports range from an all-encompassing Net Slide down to a very granular expiration-by-expiration Month Slide. Pinpoint the impact of specific positions in the Account Inventory Slide. Employ extensive “what if?” scenarios to test a portfolio’s resilience to futures and volatility moves as well as time decay. All reports can be printed or exported to a PDF or Excel for further analysis. Included with Options Pro.

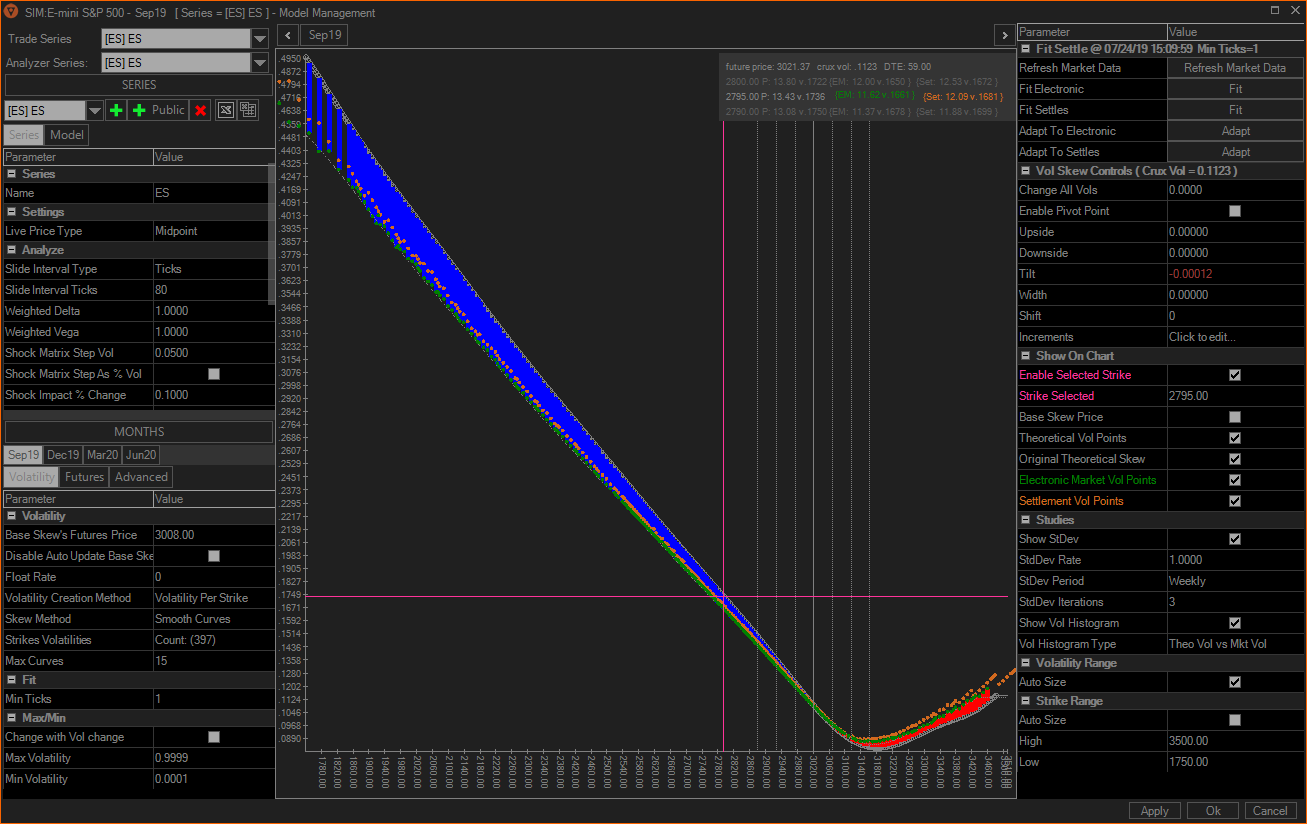

Model Management

Model Management is the backbone of our options trading software. Choose from multiple option pricing models and fit types to build a completely custom volatility skew, or use the default settings to get up and running in less than a minute. Use the implied volatility graph to visualize the entire skew and make adjustments as necessary. Included with Options Pro.

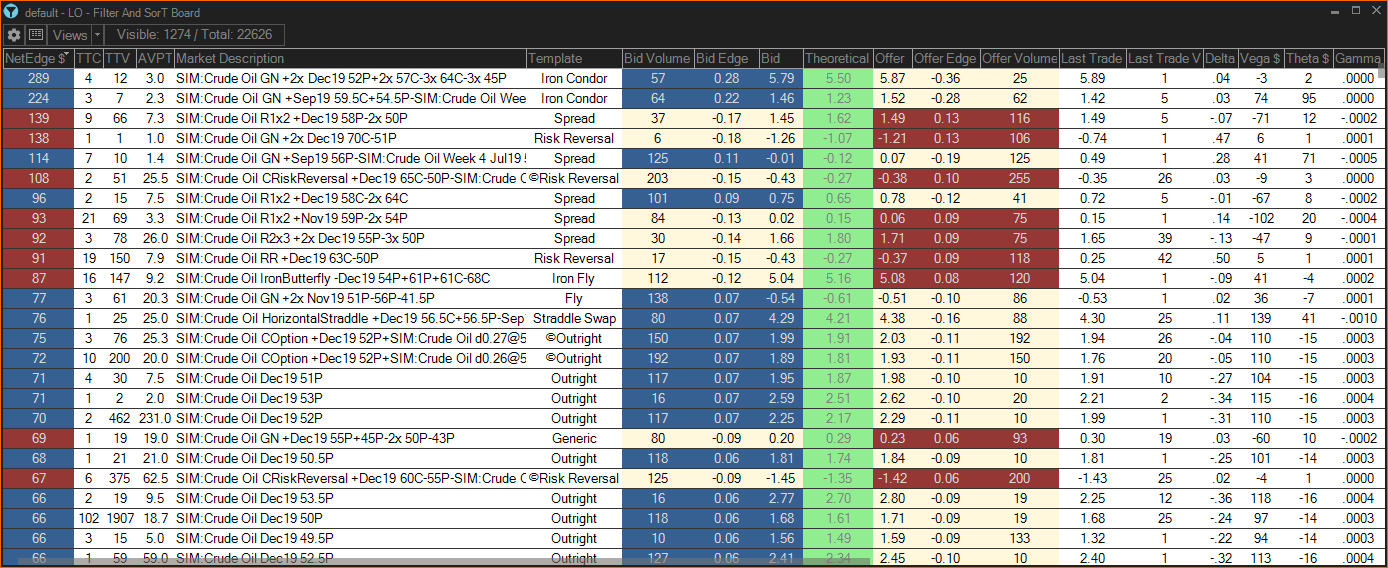

FaST Board

The Filter and Sort Board compiles thousands of outright options and spreads across multiple products into one window. Utilize more than 20 filters to narrow the list of markets to show only what matters for a particular strategy, then sort the markets based on criteria such as net edge, delta, total traded volume, etc. Trade directly from the FaST Board for quick execution of highly sought after trading opportunities. Requires Options Pro. See our pricing here.

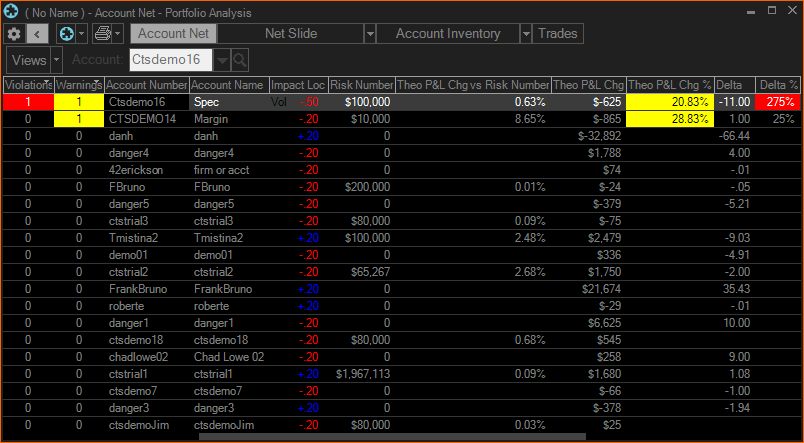

Multi Account Analysis

The Multi Account Analysis provides risk managers and firms with a compact and highly effective tool for monitoring many accounts. Risk numbers are neatly displayed in real-time and worst case scenarios are displayed to provide a quick overview of each position’s drawbacks. Net Greeks are displayed with customizable warning levels for each account so that small traders that violate their risk parameters won’t get lost behind large traders that are within bounds. Requires Options Pro. See our pricing here.

Register for a Sim Today

Start receiving real market data and experience the full functionality of CTS risk-free. Real-time data and full functionality are available for 2 weeks from the time of registration.

Want to Trade Live?

If you would like to start trading live, please contact a clearing firm that offers the CTS platform. Click the link below to find a list of licensed customer firms and their contact information.

T4 Pricing

Explore T4 package offerings and add-ons that best fit your trading needs.